Nishit Kothari 29 Jul 2017. The lRB now has to pay interest to taxpayers if they do not process their refund within 90 days from the due date electronic filing or 120 days from the due date manual filing.

See IRSgov for details.

. The due date for the CIT return on distributed profit arising from FY 2009 to FY 2013 is the date. Dis-advantages of not filing your tax return in time are. Yahoo grew rapidly throughout the 1990s.

By May 14 2022. Like many search engines and web directories Yahoo added a web portal putting it in competition with services including Excite Lycos and America Online. North Macedonia Last reviewed 13 January 2022 The due date for the CIT return is the end of February or if filled electronically 15 March following the calendar year.

052022- Central Tax dated May 17 2022 extended the due date for furnishing Form GSTR-3B for the month of April 2022 extended till the May 24 2022 due to the non-availability of Form GSTR-2B for the month of April 2022 on time ie. In 2017 the passing of 4 supplementary GST Bills in Lok Sabha as well as the approval of the same by the Cabinet. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing.

Yahoo became a public company via an initial public offering in April 1996 and its stock price rose 600 within two years. For Non-Government employees For April to February month. However currently the GST portal is aligned to charge a late fee only on returns GSTR-3B GSTR-4 GSTR-5 GSTR-5A GSTR-6 GSTR-8 GSTR-7 and GSTR.

Get up-to-date retail news Malaysia at Retail News Asia to stay ahead of the race in the retailing market and make quick decisions for your investment. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. For quarterly filing the due date for GSTR 1 is 13th of next month from the end of quarter.

The late fees will be calculated for three days and it should be deposited in cash. Here are a few of the ways you can pay your income taxes. The due date for filing TDS under Section 192 of Income Tax Act.

Therefore filling your tax electronically also means you can get your refund faster. Be aware that you can only claim your tax refund for a previous tax year within three years of the original tax returns due. More power to the Ebizfiling team for being so generous and systematic in the whole process of ESIC registration.

You will have to enter all the required details such as the month for which you are calculating GST the due date for filing. On or before the due date for filing. Malaysia Brands Top Player 2016 2017.

Will stay as a senior advisor to help continue engagement with DBSs key clients in. 08062022 Uniqlo owner to raise prices on fleece products due to weak yen Fashion 0806. Malaysia adopts the self-assessment system where the taxpayer is responsible for computing ones own chargeable income and tax payable as well as making payments of any balance of tax due.

Rajya Sabha then passed 4 supplementary GST Bills and the new tax regime implemented on 1st July 2017. Due Date for GSTR-1 Filing. In the State of Maharashtra Rs 5day is imposed as a penalty for delay in registration Interest 125 per month of delay in payment a penalty of 10 of the amount of tax in case of delaynon payment of professional tax Rs 1000 Rs 2000 penalty for delay in filing the return.

A Firm Registered with the. A taxpayer whose turnover is more than INR 15 crore needs to file GSTR 1 at 11th of the following month. GST return in GSTR-3B is filed on 23rd January 2021 3 days after the prescribed due date ie 20th January 2021.

On or before the due date for filing. Previously they had issued the advisory dated May 15 2022 to use Form GSTR-2A for the records not. The amount of tax payable for the year must be self-computed and the tax return is deemed to be a notice of assessment upon its submission.

You can prepare and e-file until the October date without filing an extension. The CBIC vide Notification No. 10000 fine for those who do not file their income tax returns ITR on time starting 2018-2019 assessment year AY.

By 1998 Yahoo was the most popular starting point for web users and the. Late fees for GSTR 1. Youll have to pay them before the due date which is 30 April 2019.

The Tax forms and Calculators Are Listed by Tax Year. Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. Back Taxes For Previous Year Tax Returns 2020 2019 2018 2017 etc.

5000 will be imposed for those whose return submitted after the due date. 1000 in penalty for small taxpayers with their total income not exceeding Rs. A taxpayer whose turnover is up to INR 15 Crore can file GSTR 1 quarterly.

Diams Iq Ip Management Software

Doing Business In The United States Federal Tax Issues Pwc

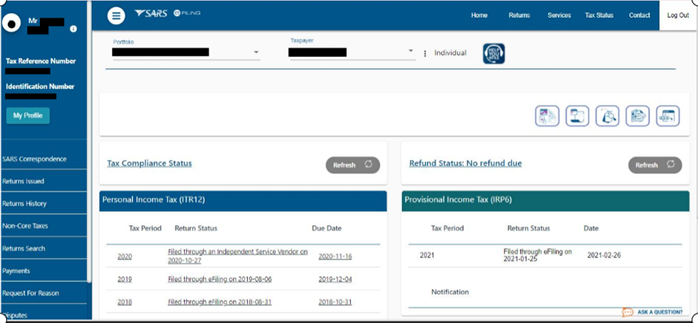

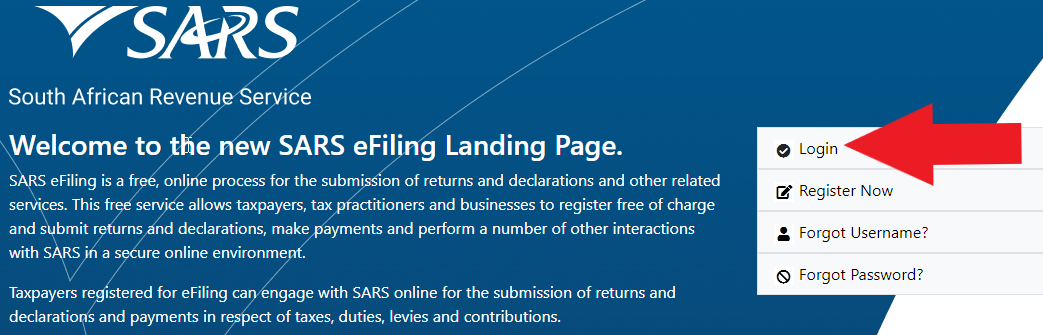

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Profile Of Respondents Download Table

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Us Taxes For Citizens Living Abroad A Guide In 2022 Wise Formerly Transferwise

Tax Compliance Advisory Malaysia Company Incorporation Consistant Info

Latest Gst Return Due Dates And Requirement To File Gstr 3b And Gstr 1

Why It Matters In Paying Taxes Doing Business World Bank Group

Why It Matters In Paying Taxes Doing Business World Bank Group

Gst Compliance Calendar For The Month Of May 2022 A2z Taxcorp Llp

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Pdf A Comparative Analysis Of Global Halal Certification Requirements